Diversification is Key: Strategies for Reducing Risk in Your Crypto Trading Portfolio

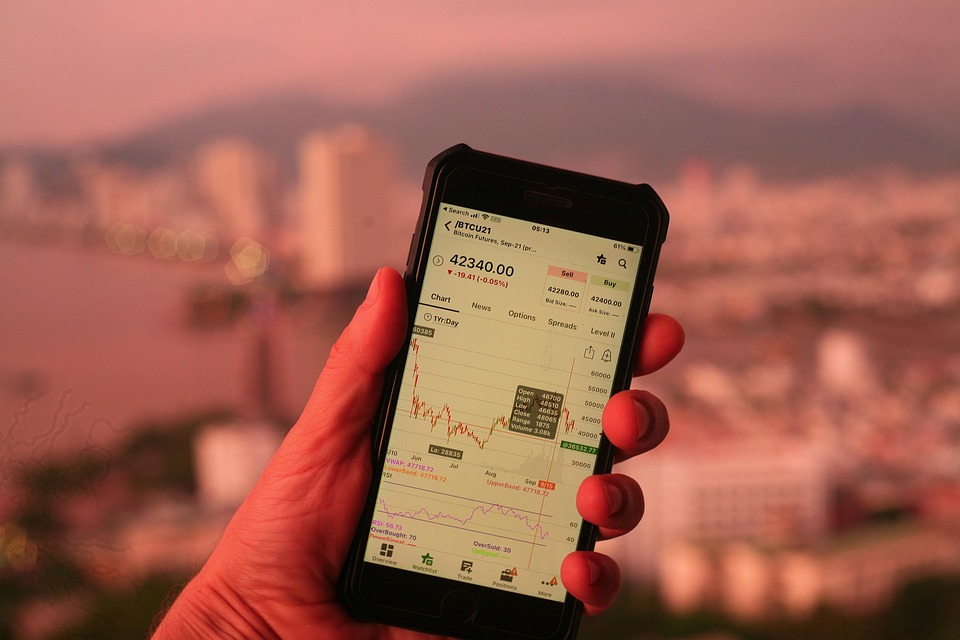

The world of cryptocurrency trading is known for its volatility, and even the most experienced traders can be caught off guard by sudden market fluctuations. One effective way to mitigate these risks is through diversification, a strategy that can help you achieve stability and potentially increase your returns in the long run.

In this article, we’ll explore the importance of diversification in crypto trading and provide you with practical strategies for reducing risk and maximizing your returns.

Why Diversification Matters

Diversification is a simple yet powerful concept: by spreading your investments across a range of assets, you reduce your exposure to any one particular asset’s risks. In the context of crypto trading, this means holding a mix of different cryptocurrencies, tokens, or assets to balance out the risks associated with each one.

Here are a few reasons why diversification is crucial in crypto trading:

- Reduced risk: By spreading your investments across multiple assets, you minimize the impact of market fluctuations in any one particular asset.

- Increased returns: Diversification can help you achieve higher returns by combining investments with different growth potential and risk profiles.

- Improved resilience: A diversified portfolio is more likely to withstand market downturns and maintain its value over time.

Strategies for Reducing Risk through Diversification

- Asset Allocation: Allocate a specific percentage of your portfolio to each asset, based on its risk profile and your investment goals.

- Diversify by Sector: Spread your investments across different sectors, such as cryptocurrencies, tokens, and commodities, to reduce exposure to any one particular area.

- Geographic Diversification: Invest in cryptocurrencies and assets from various geographic regions, such as Asia, Europe, and North America, to reduce exposure to regional market fluctuations.

- Token Diversification: Spread your investments across different tokens, each with its own unique use case, potential, and risks.

- Use Index Funds or ETFs: Invest in index funds or ETFs that track a specific market index, such as the Crypto 10 Index, to achieve diversification with a single investment.

Real-World Examples of Diversification in Crypto Trading

- Alice, a cautious trader, allocates 60% of her portfolio to stablecoins (e.g., USDT, USDC), 20% to mid-cap altcoins (e.g., Binance Coin, Chainlink), and 20% to small-cap altcoins (e.g., Solana, NEAR).

- Bob, a growth-oriented trader, invests 40% of his portfolio in cryptocurrencies with high growth potential (e.g., Dogecoin, Shiba Inu), 30% in mid-cap altcoins, and 30% in large-cap tokens (e.g., Bitcoin, Ethereum).

Conclusion

Diversification is a crucial component of a successful crypto trading strategy. By spreading your investments across a range of assets, you can reduce risk, increase returns, and improve the resilience of your portfolio. Whether you’re a beginner or an experienced trader, incorporating diversification techniques into your approach can help you achieve your investment goals and navigate the ever-volatile world of cryptocurrency trading.

Remember to stay informed, set clear goals, and continuously monitor and adjust your portfolio to ensure optimal performance. With diversification as your guiding principle, you’ll be better equipped to weather market fluctuations and reach for success in the world of crypto trading.